Table of Content

USDA rates are typically only matched by the VA loan, which is exclusively for veterans and service members. These two programs can offer below-market interest rates because their government guarantee protects lenders against loss. To find out if the property you’re buying is in a USDA-eligible area, and whether or not you meet local income limits, you can use the USDA’s eligibility maps. Business opportunity projects are used to identify and analyze business opportunities that will use local rural materials or human resources. These projects must be consistent with local and area-wide community and economic development strategic plans.

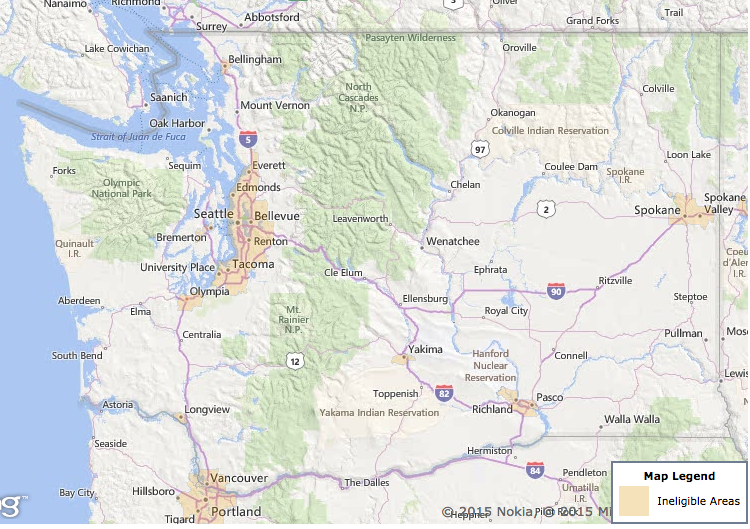

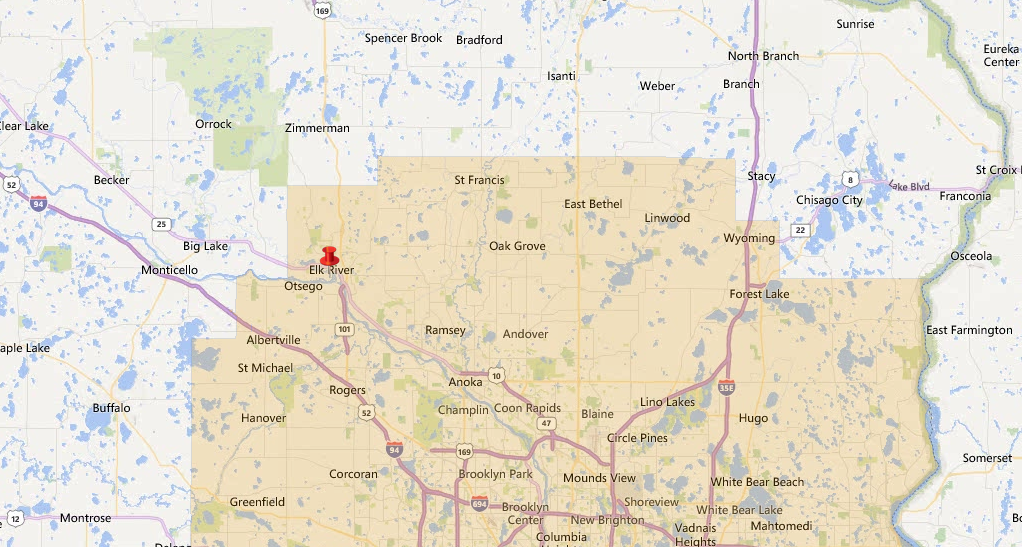

In fact, you might be surprised at just how much of the country is actually eligible for these loans. You can use this USDA eligibility map to find USDA-eligible homes in your area. Look up the address you’re interested in purchasing to verify it falls within a rural area, as determined by the U.S. Buyers who aren’t ready to commit to a specific property or realtor can use USDA’s website to answer most property-related questions and learn more about what the USDA funds can be used for. Also listed are approved lenders that can determine an interested applicant’s eligibility. A number of factors are considered when determining an applicant’s eligibility for Single Family Direct Home Loans.

Cuttler Rd New Caney Texas 77357

That said, the USDA will make exceptions for large families (i.e. five or more). These areas are the ineligible areas, whereas the unshaded areas are usually eligible. Once you visit the eligibility website, click on ‘Single Family Housing Guaranteed.’ Then, click the ‘Accept’ button to proceed. This article will help you determine if your area qualifies for a USDA loan.

USDA Rural Development supports rural prosperity in Texas by investing in modern infrastructure such as high-speed internet and water and waste treatment systems. We help eligible rural Texans buy or rent affordable housing, and we can partner with you to build or improve essential community facilities such as hospitals, libraries, and schools. We also help eligible businesses and manufacturers expand or improve, and we support energy programs that finance renewable systems for agriculture and industry.

Allow for Low Credit Scores

This means you’ll pay your taxes and insurance along with your mortgage each month. You may not pay your real estate taxes or annual homeowner insurance separately. Yes, USDA loans are eligible for refinance into another USDA loan or a conventional conforming loan. The USDA Streamline Refinance Program waives income and credit verification so closings can happen quickly. You might qualify for a USDA loan if you have an average salary for your area and a credit score of 640 or higher. USDA loans can be used to buy a home only in a rural or suburban area.

Note, however, that in some cases, you might even be able to get one with a credit score as low as 580. One of the biggest benefits of USDA loans is that they don’t require any downpayment. You can have 100% of the home financed, allowing you to make a purchase without any savings. A USDA loan is atype of mortgagethat’s sponsored by the USDA or United States Department of Agriculture. This loan is specifically designed for the purchase of rural residences and is available only to budding homeowners; investors can not make use of USDA loans.

Type of Property You Want

USDA has posted its proposed rules, revised rules and final regulations related to the development of rural areas. Customers may submit an electronic comment for any rule currently open for comment. Veterans and active US military may be eligible for a $0 down VA loan. In terms of property values, the home cannot be more than the value of the loan amount. When it comes to homes, the property must be 2,000 sq.

The evaluation criteria datasets defined below will remain unchanged for the duration of the Fiscal Year 2022 application window. To learn more about USDA home loan programs and how to apply for a USDA loan, click on one of the USDA Loan program links above and then select the Loan Program Basics link for the selected program. USDA eligible homes open the door to countless benefits. For one, USDA loans require no down payment, which can make purchasing a home significantly more affordable upfront.

Farm Loans

However, for a USDA loan it’s only .35% of your loan amount. For reference on what areas are eligible for a USDA loan,consult this tool. So, if you want to buy a fixer-upper, you can bring it back to life with the help of a USDA loan with up to 10k in repairs. Located in the enchantingly peaceful De Leon Springs, this forty-three-acre home is truly one of a kind.

This 10+ acre farm, located in the Central NW Ocala's horse country, is move-in ready. 4 lush paddocks with automatic waterers, and surrounded by board and board/wire fencing. USDA Rural Development has taken a number of immediate actions to help rural residents, businesses, and communities affected by the COVID-19 outbreak. Rural Development will keep our customers, partners, and stakeholders continuously updated as more actions are taken to better serve rural America. Scroll down to learn more about how we can help you and your community.

USDA eligibility standards are lenient in comparison to traditional mortgage loans. Aside from the income and geographic requirements, USDA approval is very generous and accommodating for modern financial and household situations. While other mortgage loans require applicants to meet a certain income, USDA sets maximum income limits. The USDA program helps lower and moderate income U.S. citizens achieve homeownership in rural areas.

We do not independently verify the currency, completeness, accuracy, or authenticity of the data contained herein. The data may be subject to transcription and transmission errors. Accordingly, the data is provided on an ‘as is, as available’ basis only.

The USDA wants to ensure that the home you choose meets certain property requirements to protect the borrower's interest and well-being. The good news is that most of the country is in what the USDA considers a qualified rural area. But it's important for prospective buyers to check a home's eligibility status before getting too far into the process. Moreover, the state won’t consider any income from anyone who doesn’t live in the house officially, such as a live-in nurse.

To find out whether you qualify for a USDA loan — and what your rate is — check with a lender below. Yes, the USDA loan program can be used to permanently install equipment to assist household members with physical disabilities. Yes, the USDA loan program can be used for newly-built homes and other new construction. Department of Agriculture lists eligible USDA communities by Census tract.

USDA Home & Property Search – USDA Homes

Additionally, officials will exclude any income from an earned income tax credit. USDA home loans don’t impose limits on what type of home you can buy. As long as you qualify, you can buy any home within an approved region. Home buyers who qualify for USDA may be able to get a deal right now.

No comments:

Post a Comment