Table of Content

These loans are specifically geared to rural areas or the suburbs and can’t be used in city limits usually. With any home purchased comes thousands of dollars worth of miscellaneous closing costs. In normal circumstances, these closing costs need to be paid in full before the transaction is finished. When you have a USDA loan, however, you can roll these closing costs into your loan. Another benefit of USDA loans is that they allow for low credit scores. Generally speaking, you can get a USDA loan with a credit score as low as 640.

USDA eligibility standards are lenient in comparison to traditional mortgage loans. Aside from the income and geographic requirements, USDA approval is very generous and accommodating for modern financial and household situations. While other mortgage loans require applicants to meet a certain income, USDA sets maximum income limits. The USDA program helps lower and moderate income U.S. citizens achieve homeownership in rural areas.

Southline St Cleveland Texas 77327

By providing affordable housing, communities will grow and thrive and the overall quality of life is positively impacted. Since the income restrictions are in favor of lower earners, many applicants who may have been turned down elsewhere may be approved for a USDA loan via an approved mortgage lender. A USDA loan is a great option for buyers with moderate or low income. It lets you buy a house with no money down and low mortgage rates — two huge benefits that only one other loan program offers.

USDA mortgage insurance rates are lower than those for conventional or FHA loans. Thanks to this government guarantee, lenders can offer 100% financing and below-market interest rates without taking on too much risk. Other mortgage programs, like the FHA loan and conventional loan, can have rates around 0.5%-0.75% higher than USDA rates on average. Getting a USDA loan doesn’t necessarily mean your rate will be “below-market” or match the USDA loan rates advertised. Compared to other home loan programs, USDA mortgage interest rates are some of the lowest available.

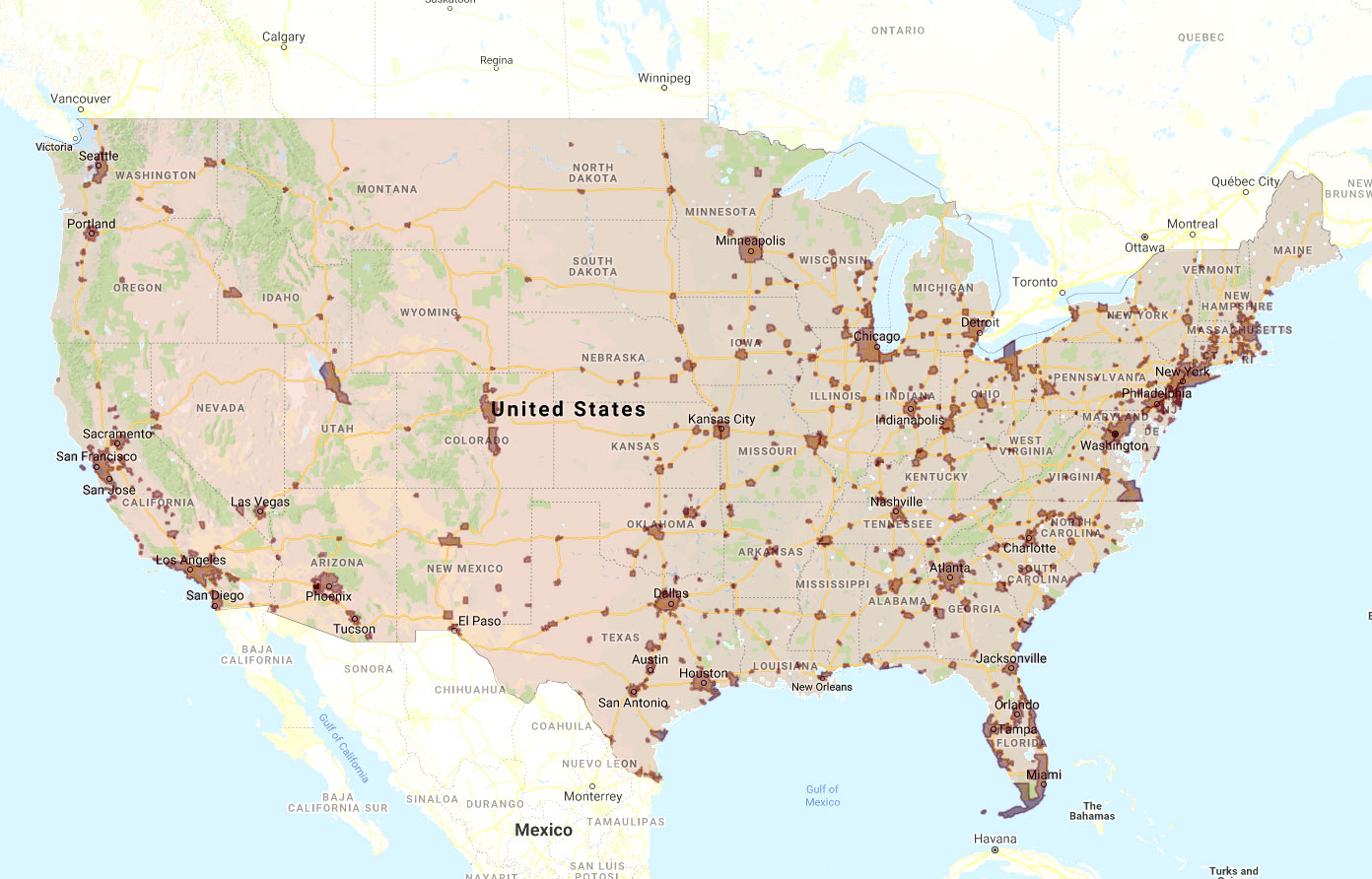

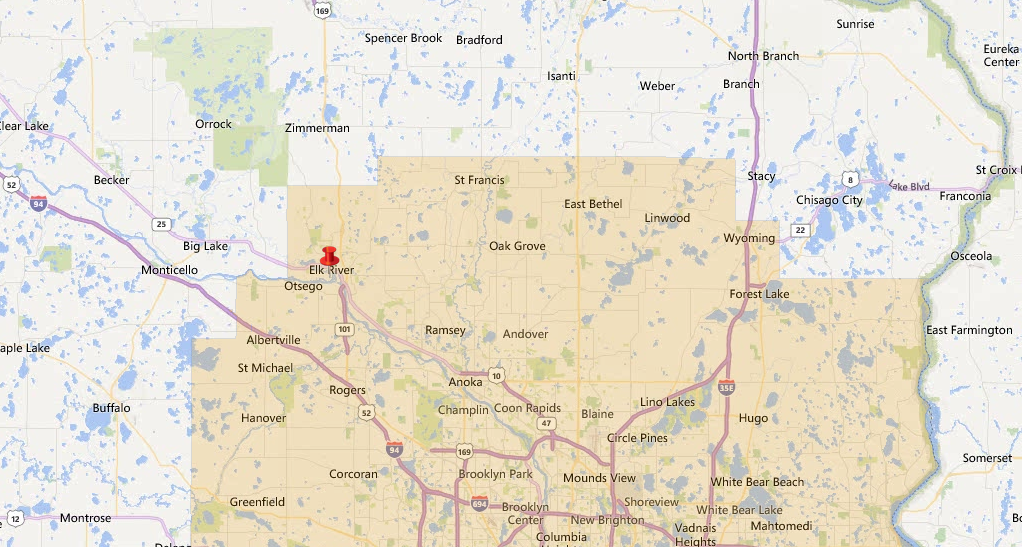

Using the USDA Eligibility Map

ICB Solutions and Mortgage Research Center receive compensation for providing marketing services to a select group of companies involved in helping consumers find, buy or refinance homes. If you submit your information on this site, one or more of these companies will contact you with additional information regarding your request. By submitting your information you agree Mortgage Research Center can provide your information to one of these companies, who will then contact you. Neither Mortgage Research Center nor ICB Solutions guarantees that you will be eligible for a loan through the USDA loan program. USDALoans.com will not charge, seek or accept fees of any kind from you. Mortgage products are not offered directly on the USDALoans.com website and if you are connected to a lender through USDALoans.com, specific terms and conditions from that lender will apply.

Finally, USDA loans also have lax credit standards compared to many mortgage loan options. That can make it easier to qualify for the loan in the first place. Providing these affordable homeownership opportunities promotes prosperity, which in turn creates thriving communities and improves the quality of life in rural areas. Effective December 1, 2022, the current interest rate for Single Family Housing Direct home loans is 3.75% for low-income and very low-income borrowers. USDA loan requirements are not as stiff or stringent as you might think. The stipulations are merely in place to ensure that only those that qualify may obtain a mortgage through this type of program.

1616 Eagle Lake Road Sealy Texas 77474

The USDA mortgage program is intended for home buyers with low-to-average incomes. In addition, you must buy a home in a “rural area” to qualify. Those who are eligible can use a USDA mortgage to buy a home or refinance one they already own. The last con of USDA loans is that they come with income limits. These limits vary based on the county but are generally around $90,000 for 1 to 4-member households and around $119,000 for 5 to 8-member households.

Overall, all household members cannot have an income that’s more than 115% of the median income of the area. Plus, the USDA won’t consider any income earned from a minor. You’ll find that the bigger cities within a state are shaded. The mapping tool also allows you to look at homes for sale in eligible areas.

Check Official USDA Loan Requirements

That home will also need to be your primary residence — not an investment or income-earning property. Applicants must meet income eligibility for a direct loan. Please select your state from the dropdown menu above. For instance, loan officials disqualify any type of capital gains, insurance money, or inheritance money as official income sources.

To assess potential eligibility of an applicant/household, click on one of the Single Family Housing Program links above and then select the applicable link. Applications for this program are accepted through your local RD office year round. As with any other mortgage, you will be required to obtain an appraisal for your new home. The difference is that the appraiser must also state that the condition of the home meets USDA standards. If any of the above mirrors your situation or finances, a USDA loan might be the perfect option for you and your family.

But in fact, 97% of the U.S. map is eligible for USDA loans, including many suburban areas near major cities. Any area with a population of 20,000 or less can be an eligible rural area. The only exception is for very-low-income borrowers, who may qualify for a USDA Direct home loan. In this case, you’d go straight to the Department of Agriculture to apply rather than to a private lender.

With USDA-guaranteed loans, mortgage insurance premiums are just a fraction of what you’d typically pay. Even better, USDA mortgage rates are often the lowest among FHA mortgage rates, VA mortgage rates, and conventional loan rates — especially when buyers are making a small or minimum down payment. Another constant among financed mortgages is the necessity for closing costs. Closing costs are used to pay for third-party services like appraisals, credit checks, and title work.

You will then receive an email that helps you regain access. Scroll down to learn more about how we can help you and your community or visit our Texas contact page. If you’re interested in getting a USDA loan, all you need to do is talk to a participating lender. Mortgage insurance is usually between 0.5% and 1.5% of the original loan amount, paid each and every year. On a monthly basis, you can expect it to bump your cost up around $100 to $200.

No comments:

Post a Comment